India’s Cryptocurrency Regulation in 2024: Insights from the Reserve Bank of India

The landscape of cryptocurrency regulation in India has undergone significant changes leading up to 2024. With the Reserve Bank of India (RBI) at the helm of these developments, the legal framework surrounding cryptocurrency has evolved to address the complexities of digital assets. This article explores the current regulations, taxation policies, and the broader implications of these changes for investors and the crypto market in India.

Is Cryptocurrency Legal in India?

As of now, cryptocurrency in India occupies a complex legal space. While bitcoin and other cryptocurrencies are not recognized as legal tender, they are not outright illegal either. The Reserve Bank of India (RBI) has expressed concerns regarding the volatility and potential for laundering, leading to an unregulated environment for crypto trading and crypto transactions. However, the government is working on a regulatory framework to oversee crypto exchanges and ensure compliance. The official digital currency bill aims to establish a clear regulation of official digital currency and could shape India’s cryptocurrency landscape by 2024.

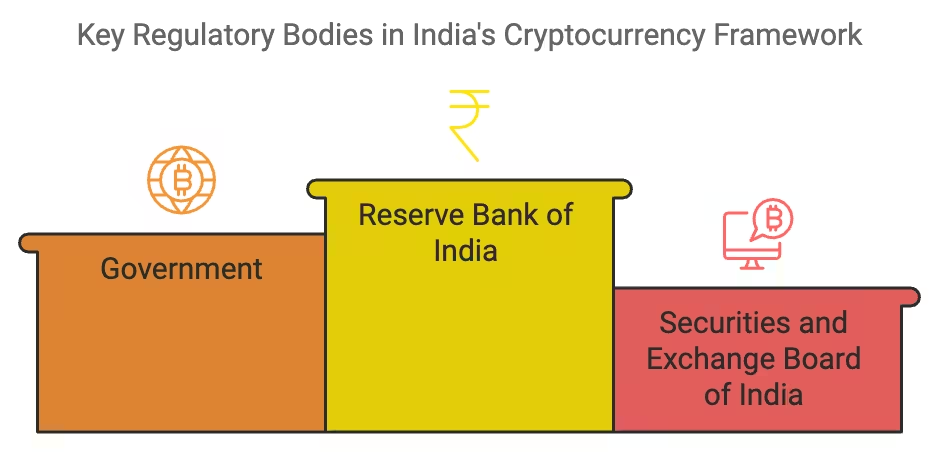

In the Union Budget 2022, the government introduced a tax regime for crypto assets, imposing a tax on crypto at a flat rate of 30%. This move signaled an acknowledgment of digital assets as part of the financial ecosystem. The Exchange Board of India (SEBI) is also expected to play a role in regulating cryptocurrency and overseeing trading in cryptocurrencies. With the growing interest among investors and the rise of crypto exchanges, the need for a robust framework for crypto is more pressing than ever to ensure the safe and legal use of virtual currencies.

What are the current regulations for cryptocurrency in India?

Overview of cryptocurrency regulation in 2024

As of 2024, the regulatory landscape for cryptocurrency in India has become more structured, with the RBI playing a pivotal role. The introduction of the official digital currency bill marks a significant step towards regulating the use of virtual currencies, which includes various cryptocurrencies such as Bitcoin and Ethereum. This regulatory framework aims to create a safe environment for investors while mitigating risks associated with unregulated trading and market volatility. The government has emphasized the need for compliance among crypto exchanges, ensuring that they adhere to specified regulations to protect investors. Consequently, the rise of a legal framework is expected to bolster investor confidence and encourage responsible trading in cryptocurrencies.

Key regulations introduced by the Reserve Bank of India (RBI)

The Reserve Bank of India has introduced several key regulations aimed at overseeing the cryptocurrency landscape effectively. These regulations include stringent Know Your Customer (KYC) requirements for crypto exchanges, ensuring that trading activities are transparent and traceable. Additionally, the RBI has mandated the implementation of Anti-Money Laundering (AML) measures to combat the potential misuse of cryptocurrencies for illicit activities. By fostering a regulatory environment that prioritizes compliance, the RBI aims to establish a robust framework for crypto transactions. Moreover, these regulations will likely lead to the creation of a more organized market for digital assets, providing a clear path for existing and new investors to navigate the complexities of cryptocurrency trading.

Impact of the crypto bill on crypto trading

The introduction of the crypto bill by the Government of India is expected to have a profound impact on crypto trading in the country. By providing a legal status to cryptocurrencies, the bill seeks to legitimize the use of digital assets, thus fostering a sense of security among investors. This regulatory acknowledgment will likely encourage more individuals to participate in the crypto market, boosting trading volumes and liquidity. Furthermore, the bill’s emphasis on compliance will enhance the credibility of crypto exchanges, making them more attractive to institutional investors. As a result, the overall landscape of cryptocurrency trading in India may shift towards a more regulated and mature environment, paving the way for greater innovation and advancements in blockchain technology.

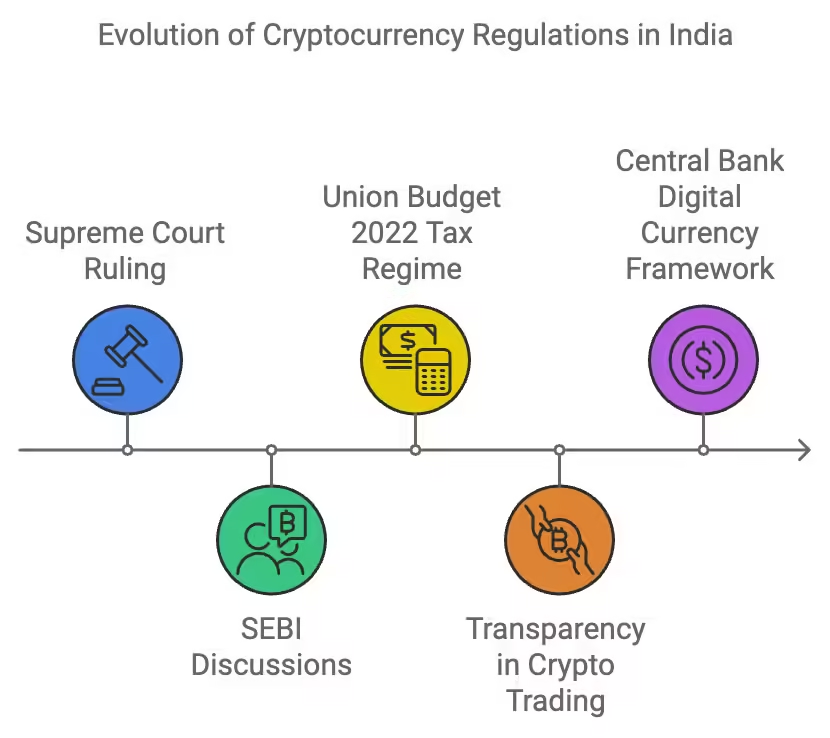

Timeline Of Crypto Tax Regulations In India

In 2021, India witnessed significant developments regarding the taxation of virtual digital assets and private cryptocurrencies. The Supreme Court of India ruled in favor of cryptocurrency legality, paving the way for clearer regulations. The Securities and Exchange Board of India (SEBI) began discussions on the oversight of crypto activities, emphasizing the need for robust frameworks to address financing of terrorism concerns and protect investors.

In the Union Budget 2022, the government introduced a new tax regime that imposed a tax on income generated from the transfer of digital assets. Under the Income Tax Act, any income from the transfer of cryptocurrency is now taxable in India, with traders required to report their cost of acquisition and earnings. This move aims to bring transparency to crypto exchanges and traders, while also acknowledging that cryptocurrencies are legal financial instruments within the country.

Furthermore, the government is working on a comprehensive cryptocurrency and regulation of official digital currency framework, which includes the role of the central bank in potential issuance of a central bank digital currency (CBDC). As the global crypto landscape evolves, India’s crypto regulations are set to adapt, balancing innovation with necessary tax laws to ensure the safe use of cryptocurrency within its economy.

Why is Crypto Regulation Important in India?

Regulating cryptocurrency in India is essential for fostering a secure and transparent financial environment. As cryptocurrency exchanges proliferate, the need for comprehensive regulations in place becomes apparent. The bill 2021 aimed to establish a legal framework, yet uncertainties persist regarding the current legal status of these digital assets. The union budget 2022 introduced measures to outline tax implications for trading cryptocurrencies, ensuring that tax authorities can effectively monitor and tax gains from initial coin offerings and other digital transactions.

Moreover, without proper regulation of cryptocurrency, investors are exposed to significant risks, including fraud and market volatility. The Indian government’s steps towards implementing regulations aim to protect consumers and promote responsible trading of cryptocurrencies. By establishing clear guidelines, the nation can encourage innovation while safeguarding its financial ecosystem, ultimately leading to a more stable market for all participants involved in trading cryptocurrencies.

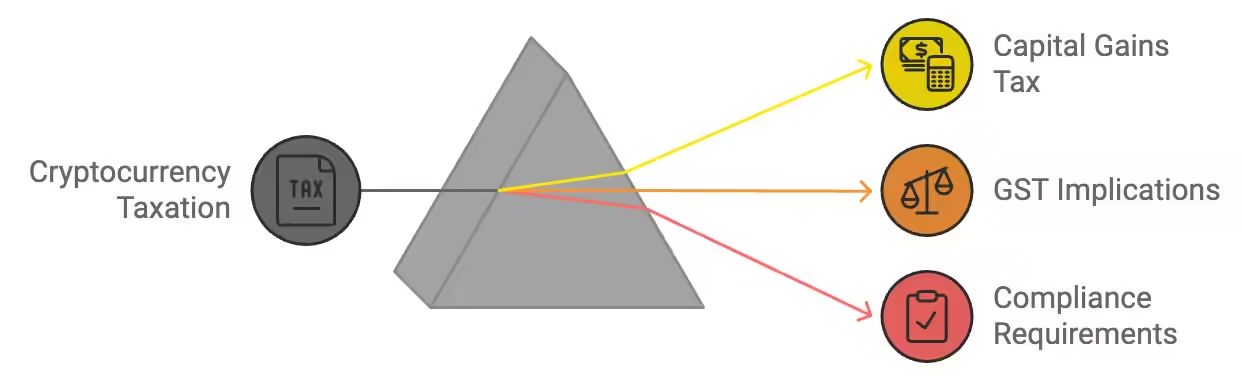

How is cryptocurrency taxed in India?

Understanding the tax on crypto transactions

In India, the taxation of cryptocurrency transactions has become a focal point of discussion among investors and regulators alike. As per the current tax regime, profits from crypto transactions are subject to capital gains tax, which is applicable to both short-term and long-term holdings. The government has established clear guidelines for calculating the tax on crypto transactions, providing a framework that aims to bring transparency to the taxation process. Additionally, any income generated from trading in cryptocurrencies is categorized under ‘income from other sources,’ making it essential for investors to maintain accurate records of their transactions. This clear tax structure is intended to promote compliance among crypto investors and minimize the risks associated with tax evasion.

Goods and Services Tax (GST) implications for cryptocurrencies

The implementation of the Goods and Services Tax (GST) on cryptocurrency transactions adds another layer to the tax framework in India. Under the current regulations, crypto transactions are subject to GST, which applies to the sale of virtual assets. This means that investors need to factor in GST when calculating their overall tax liability on crypto transactions. The introduction of GST aims to ensure that cryptocurrencies are treated similarly to other goods and services in terms of taxation, thus promoting fairness and consistency in the tax regime. As the regulatory environment continues to evolve, understanding the implications of GST on cryptocurrency transactions will be crucial for investors seeking to navigate the complexities of the Indian tax system.

Compliance requirements for crypto investors

Compliance requirements for crypto investors in India have become increasingly stringent as the regulatory framework develops. Investors are now obligated to report their crypto transactions accurately, ensuring that they adhere to the tax regulations set forth by the government. This includes maintaining detailed records of all trades, including dates, amounts, and the nature of transactions. The RBI and the Government of India have emphasized the importance of compliance to mitigate the risks associated with money laundering and tax evasion. As a result, investors must familiarize themselves with the compliance landscape to avoid penalties and legal repercussions. This growing focus on compliance is indicative of a maturing crypto market in India, where responsible trading practices are encouraged and supported.

What is the legal status of cryptocurrency in India?

Legal framework surrounding cryptocurrencies

The legal status of cryptocurrency in India has been a topic of considerable debate, and recent developments have clarified its standing within the regulatory framework. While cryptocurrencies are not recognized as legal tender, the Government of India has taken steps to create a regulatory framework that acknowledges their existence. The introduction of the official digital currency bill signifies a commitment to regulating cryptocurrencies while exploring the potential of a state-backed digital currency. This legal framework aims to address the challenges posed by unregulated crypto activities while providing a pathway for legitimate use of digital assets. As the landscape continues to evolve, the legal recognition of cryptocurrencies is expected to play a crucial role in shaping the future of the Indian crypto market.

Distinction between legal and illegal crypto activities

Understanding the distinction between legal and illegal crypto activities is essential for investors navigating the Indian cryptocurrency landscape. Legal activities encompass trading in registered cryptocurrencies through compliant exchanges, adhering to KYC and AML regulations. In contrast, illegal activities may involve trading unregulated tokens or engaging in practices that violate existing laws. The government has taken a firm stance against illegal crypto activities, emphasizing the need for compliance and transparency. Investors must be vigilant to ensure that their trading practices align with the legal framework established by the RBI and the government. This clarity in the legal standing of cryptocurrencies is anticipated to enhance investor confidence and promote responsible trading behaviors in the Indian crypto market.

Future prospects for legal tender status

The future prospects for granting cryptocurrencies legal tender status in India remain uncertain. While the government has expressed interest in exploring a state-backed digital currency, the potential for existing cryptocurrencies to achieve legal tender status is still under discussion. Factors influencing this decision include concerns about financial stability, consumer protection, and the need for a robust regulatory framework. As the global landscape of cryptocurrency continues to evolve, the Indian government will likely weigh the benefits and risks of adopting cryptocurrencies as legal tender. This ongoing dialogue surrounding legal tender status reflects the dynamic nature of the cryptocurrency market and the need for responsive regulatory measures to safeguard the interests of investors and the economy.

How do Indian regulations compare with other countries?

Countries where cryptocurrency is fully regulated

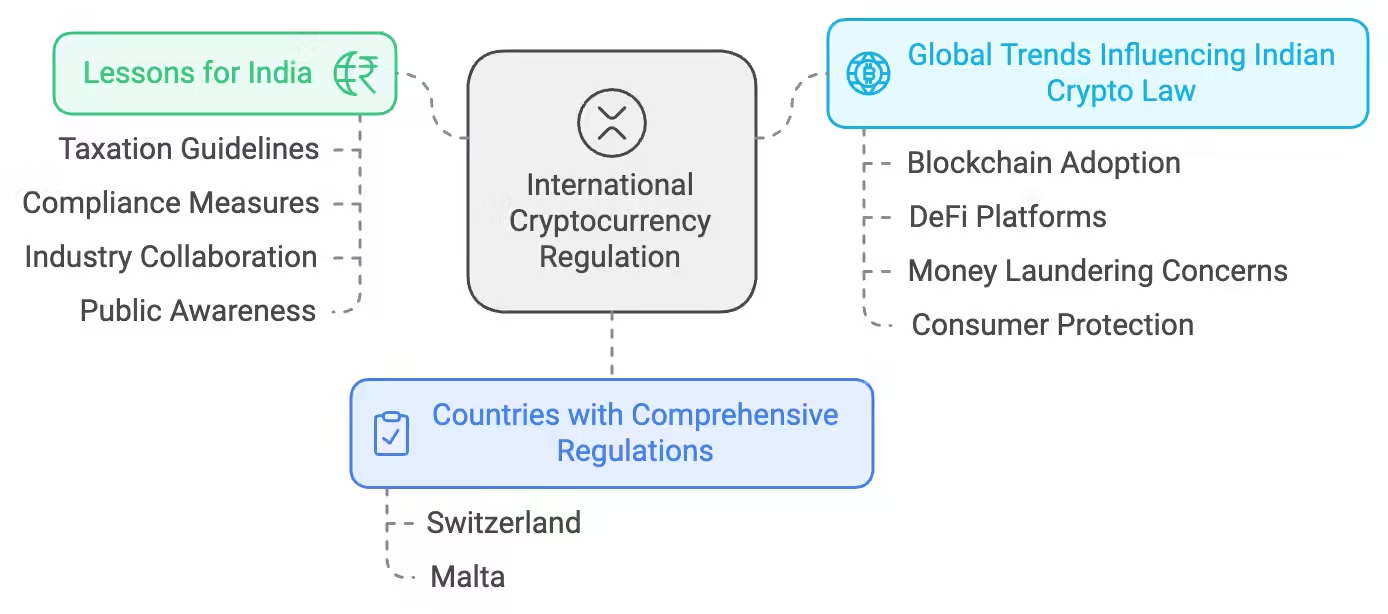

In the global context, several countries have established comprehensive regulations for cryptocurrency, setting benchmarks for India to consider. Countries such as Switzerland and Malta have implemented frameworks that allow for the seamless integration of cryptocurrencies within their financial systems. These nations recognize cryptocurrencies as legal assets, providing clear guidelines for taxation, trading, and compliance. The success of these regulatory models showcases the potential benefits of a structured approach to cryptocurrency regulation. As India moves towards developing its regulatory framework, it can draw valuable lessons from these examples to create a balanced environment that fosters innovation while ensuring investor protection.

Lessons from international cryptocurrency regulation

International cryptocurrency regulation offers crucial insights that can inform India’s approach to governing digital assets. Key lessons include the importance of establishing clear guidelines for taxation and compliance, which can help prevent tax evasion and illicit activities. Additionally, fostering collaboration between regulatory bodies and the crypto industry can lead to more effective oversight and innovation. Countries that have successfully regulated cryptocurrencies often emphasize the need for public awareness and education regarding digital assets, helping to create an informed investor base. By learning from these international experiences, India can craft a regulatory framework that is both effective and conducive to the growth of the crypto market.

Global trends influencing Indian crypto law

Global trends in cryptocurrency regulation are playing a significant role in shaping Indian laws and regulations. The increasing adoption of blockchain technology and the rise of decentralized finance (DeFi) platforms are prompting regulators worldwide to reassess their approaches to cryptocurrency. Additionally, the growing concern over issues such as money laundering and consumer protection is influencing how countries like India formulate their regulatory frameworks. By monitoring these global trends, Indian policymakers can develop a forward-thinking approach that addresses the unique challenges posed by cryptocurrencies while fostering a safe and vibrant crypto market. The interplay between international developments and local regulations will be crucial in determining the future of cryptocurrency in India.

What measures are in place to prevent money laundering in crypto?

Anti-money laundering (AML) regulations in crypto

Anti-money laundering (AML) regulations are a cornerstone of India’s approach to cryptocurrency oversight. The RBI has implemented strict AML measures that require crypto exchanges to conduct thorough KYC checks on their users. These regulations aim to deter money laundering and other illicit activities by ensuring that all transactions are traceable and compliant with established laws. Furthermore, exchanges must report suspicious activities to the authorities, facilitating timely intervention when necessary. By enforcing robust AML regulations, India is taking proactive steps to protect its financial system and foster a more secure environment for crypto trading.

Compliance frameworks for crypto exchanges

The compliance frameworks established for crypto exchanges in India are designed to ensure that these platforms operate within the legal boundaries set by regulatory authorities. Crypto exchanges are required to implement comprehensive KYC processes and adhere to AML guidelines. This includes maintaining detailed transaction records and reporting any suspicious activities to the relevant authorities. The RBI’s oversight extends to ensuring that exchanges are equipped with the necessary tools to comply with these regulations effectively. Through stringent compliance requirements, the government aims to enhance the integrity of the crypto market while promoting responsible trading practices among investors.

Role of the Ministry of Finance in crypto oversight

The Ministry of Finance plays a crucial role in overseeing the cryptocurrency landscape in India. It works in conjunction with the RBI and other regulatory bodies to develop policies that govern the use of digital assets. The ministry’s involvement ensures that the regulatory framework remains aligned with the country’s financial goals and objectives. Additionally, the Ministry of Finance is responsible for evaluating the implications of cryptocurrency on the broader economy, including potential risks related to money laundering and tax evasion. By providing strategic guidance and oversight, the Ministry of Finance contributes to the establishment of a comprehensive regulatory environment for cryptocurrencies in India.

What are the potential impacts of cryptocurrency regulations on the market?

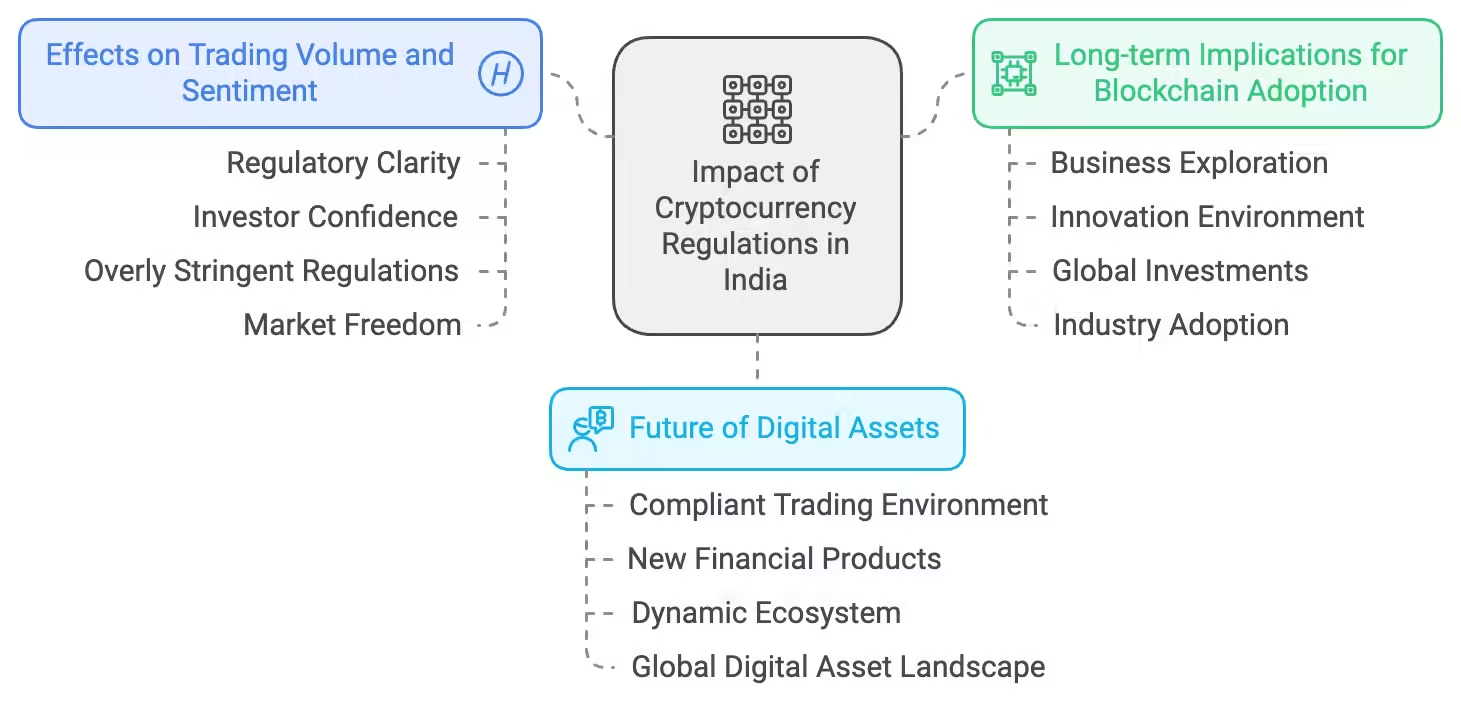

Effects on crypto trading volume and investor sentiment

The implementation of cryptocurrency regulations in India is expected to have significant effects on crypto trading volume and investor sentiment. As regulatory clarity increases, more investors may feel encouraged to enter the crypto market, leading to higher trading volumes. The establishment of a legal framework will likely enhance investor confidence, as individuals seek to engage in secure and compliant trading practices. Conversely, overly stringent regulations could deter some investors from participating in the market, potentially leading to volatility in trading volumes. Striking a balance between regulation and market freedom will be essential to foster a vibrant crypto ecosystem in India where investors feel secure and supported.

Long-term implications for blockchain technology adoption

The long-term implications of cryptocurrency regulations extend beyond the immediate crypto market, significantly impacting blockchain technology adoption in India. As regulations become clearer, businesses may be more inclined to explore blockchain applications, recognizing the potential benefits of this technology. The regulatory framework can facilitate innovation by providing a conducive environment for startups and established companies to experiment with blockchain solutions. Furthermore, as more sectors begin to adopt blockchain technology, India could emerge as a leader in this space, attracting global investments and talent. Ultimately, the regulation of cryptocurrencies may catalyze a broader acceptance of blockchain technology across various industries, driving economic growth and technological advancement.

Future of digital assets in India post-regulation

The future of digital assets in India post-regulation appears promising, with the potential for significant growth and innovation in the crypto market. As regulations take shape, the establishment of a compliant trading environment is expected to attract both domestic and international investors. Moreover, the recognition of cryptocurrencies as legitimate financial instruments could lead to the development of new financial products and services tailored to the needs of investors. This evolution will likely foster a more dynamic crypto ecosystem, where innovation thrives, and technological advancements are embraced. Overall, the regulatory framework is poised to position India as a formidable player in the global digital asset landscape, paving the way for a robust and sustainable crypto market.

Q: What is the current status of cryptocurrency regulation in India as of 2024?

A: As of 2024, the Reserve Bank of India has implemented a framework for regulating cryptocurrency, focusing on the classification of digital currencies as crypto assets. This regulation aims to ensure consumer protection and mitigate risks associated with digital currencies.

Q: How does the Reserve Bank of India classify cryptocurrency?

A: The Reserve Bank of India classifies cryptocurrency as a digital asset, emphasizing its role as a crypto asset rather than a traditional currency. This classification helps in framing regulations that address the unique characteristics of these digital currencies.

Q: Are cryptocurrencies considered legal currency in India?

A: No, cryptocurrencies are not considered legal currency in India. They are classified as crypto assets, which means they can be traded and held, but they do not have the same status as the Indian Rupee or other recognized legal tender.

Q: What measures has the Reserve Bank of India taken to regulate crypto assets?

A: The Reserve Bank of India has introduced measures such as mandatory registration for cryptocurrency exchanges, KYC (Know Your Customer) compliance, and monitoring of transactions involving crypto assets to prevent money laundering and fraud.

Q: How does regulation affect cryptocurrency trading in India?

A: Regulation affects cryptocurrency trading by introducing compliance requirements for exchanges and traders. This includes reporting suspicious transactions and adhering to anti-money laundering norms, which aims to create a safer trading environment for users of crypto assets.

Q: Will the regulations impact the growth of cryptocurrency in India?

A: The regulations may initially pose challenges to the growth of cryptocurrency in India; however, they also aim to establish a more secure framework that could boost investor confidence in the long term, potentially leading to increased adoption of crypto assets.

Q: What are the potential penalties for non-compliance with cryptocurrency regulations?

A: Non-compliance with cryptocurrency regulations can lead to significant penalties, including fines, suspension of operations for exchanges, and potential legal action against individuals or companies engaging in illegal cryptocurrency activities.

Q: How does the Reserve Bank of India view the future of cryptocurrency?

A: The Reserve Bank of India recognizes the potential of cryptocurrency and digital assets but emphasizes the need for proper regulation to address the associated risks. The central bank is exploring further developments in the sector while ensuring consumer protection and financial stability.

Q: Are there any specific guidelines for investors in crypto assets?

A: Yes, the Reserve Bank of India advises investors to conduct thorough research before investing in crypto assets, understand the risks involved, and be aware of the regulatory framework in place. Investors are encouraged to use regulated platforms for trading to ensure their safety.

How can I trade Bitcoin legally in India?

To trade Bitcoin legally in India, first, choose a reputable exchange that complies with local regulations. Ensure the platform supports cryptocurrency trading and provides secure wallet options. Familiarize yourself with the legal implications since cryptocurrency is a digital asset, and stay updated on tax obligations related to trading profits.

How is 30% tax on cryptocurrency in India?

India has implemented a 30% tax on cryptocurrency earnings, reflecting its commitment to regulate the digital asset market. This tax applies to any gains made from buying and selling cryptocurrencies, ensuring that investors are taxed on their profits.

Furthermore, no deductions are allowed on losses, making it crucial for investors to strategize carefully. This regulatory framework aims to bring transparency and accountability to the burgeoning crypto sector.

What are the rules of trading Bitcoin?

When trading Bitcoin, it’s crucial to understand market trends and analysis. Always set a budget and never invest more than you can afford to lose. Utilize stop-loss orders to minimize potential losses, and keep emotions in check to avoid impulsive decisions. Stay informed about regulations affecting cryptocurrency trading.

Can I sell my Bitcoin for cash in India?

Yes, you can sell your Bitcoin for cash in India through various cryptocurrency exchanges that support INR transactions. Popular platforms like WazirX and CoinSwitch Kuber allow users to sell their Bitcoin easily.

Once the sale is completed, you can withdraw the funds directly to your bank account.

Is it legal to sell Bitcoin in India?

In India, it is legal to sell Bitcoin. The government has not imposed a ban on cryptocurrency trading, allowing individuals to buy and sell Bitcoin through various exchanges. However, regulatory frameworks are evolving, and users should stay informed about tax obligations and compliance requirements related to cryptocurrency transactions.

Can you sell Bitcoin for actual cash?

Yes, you can sell Bitcoin for actual cash. Many cryptocurrency exchanges allow users to convert their Bitcoin into local currency. Once sold, the funds can be withdrawn to a bank account or an online payment service.

Additionally, peer-to-peer platforms enable direct transactions between individuals, facilitating cash sales.

Always ensure to adhere to local regulations and understand the associated fees when converting Bitcoin to cash.

Is Bitcoin Cash available in India?

Yes, Bitcoin Cash is available in India. Various cryptocurrency exchanges facilitate the buying and selling of Bitcoin Cash alongside other cryptocurrencies. Users can easily trade it using popular platforms, ensuring accessibility for both beginners and experienced investors. However, it’s essential to stay updated on local regulations regarding cryptocurrencies.

How much is 1 Bitcoin in 1 rupee?

As of October 2023, the value of 1 Bitcoin can vary significantly, but it often hovers around 5 million rupees. The fluctuation in cryptocurrency prices means that this conversion rate is subject to change. Investors should regularly check current exchange rates for accurate information.

Is it legal to buy bitcoin in India?

Bitcoin has become a popular cryptocurrency, and its value fluctuates significantly. As of the latest updates, the conversion rate of 1 Bitcoin to 1 rupee can vary daily based on market conditions. Investors need to check real-time data for accurate and current exchange rates.